Craig heads up the Mayday Group, a company in the insurance sector. They specialise in medical assistance, travel claims and repatriation services.

When Craig first approached us in 2017, the business was growing fast. Their existing claims management system was struggling. Workflows with many moving parts. Staff across Europe. Hundreds of cases ongoing, 24/7. All to enable the Mayday Group to provide their services and meet regulations.

Easy claims handling

All information in one place

We have created a claims handling process which allows users to see all critical elements of a claim. Managers can assign claims and tasks to staff members to complete.

The software restricts sensitive information, such as bank details, to certain team members. This allows the Mayday Group to maintain GDPR and regulatory compliance. We keep full audit logs within the software, allowing staff to fulfil claim compliance tasks.

Information is available to those who need it, at a touch of a button.

Step-by-step repatriation workflows

To get claimants home as swiftly as possible

There are so many moving parts in repatriation. The repatriated claimant, their companions, a medical escort, luggage and any required medical equipment.

Craig's teams can now manage all these elements and journey legs from one central place. The software incorporates medical documents, statements, reviews and travel papers within the workflow. We've streamlined the entire process for the operations team, including some automated emails.

Everything is in one place to save time and keep repatriations smooth.

External communications, automated

To keep things flowing

Aside from automated emails, the software does plenty of heavy lifting. The APIs we created allow our software to ‘speak’ and transfer data to other systems. This means staff can manage claims created in other places, without any double data entry. They can concentrate on dealing with the information fed through to the software.

External parties like underwriters can view and approve certain details on a claim. They have restricted-access dashboards to review claims, meaning faster decision-making.

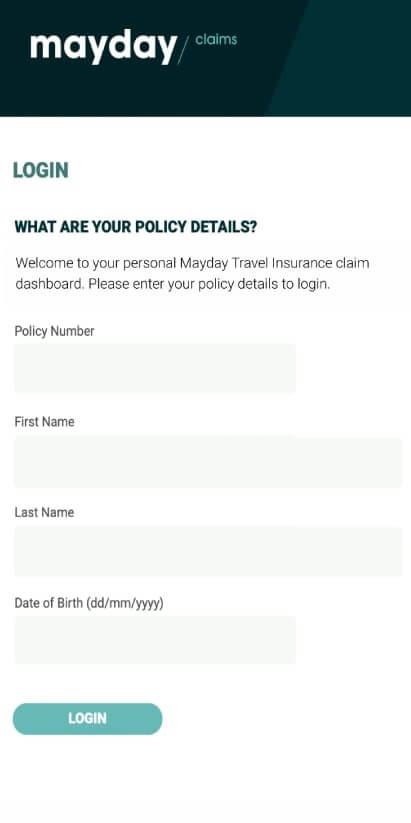

We have also created a customer-facing website for claims submissions. Customers can submit claims directly into Mayday’s software. This eliminates the need for paper-based forms and speeds up claim processing time. This customer portal can also be white-labelled, meaning Craig can offer personalised claims handling services to corporate clients.

Automations reduce manual admin time, keeping the important decisions for humans.

Reports on demand

To inform business decisions

The custom software we’ve built for Craig has many reports to meet internal and external needs. Insurance sector-specific bordereau and underwriter reports keep their clients happy. And data on the Mayday Group's own activities helps to inform strategic decisions.

The key information, as they need it.

Now, how can we help you?

Are you like Craig?

We can create custom software to enable your business to scale up. Get in touch to talk to us about your challenges.

hey!

We build custom software with your team, for your team. Our apps and web platforms bring about meaningful change for businesses across the UK.